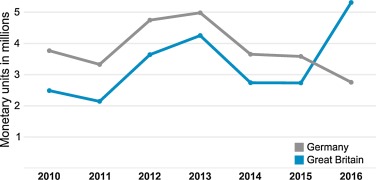

Energy storage landscape in UK and Germany: 2010-2016

September 3, 2018.

Annual revenues for time-shifting energy with a 1000 MWh, 125 MW storage device with 75% round-trip efficiency. Monetary unit scale is millions of EUR for Germany or GBP for Britain.

I am pleased to write this post highlighting our recent paper, An analysis of storage revenues from the time-shifting of electrical energy in Germany and Great Britain from 2010 to 2016. This was published in the Journal of Energy Storage in June and the work was led by my colleague Dr Grant Wilson at the University of Birmingham.

The paper investigates the changing electricity market conditions for bulk electricity storage in the UK and German markets during the period 2010-2016, during which time the price profiles of the two countries have changed significantly. This is due to several reasons as discussed in the paper, but it is especially due to increasing deployments of renewable energy generation, with the UK having deployed nearly 10 GW of solar and 14 GW of wind during this period. Germany has deployed 30 GW of solar and nearly 25 GW of wind during this period.

We examine the potential revenue that a large scale pumped hydroelectric storage plant could have generated during these years as well as analysing the electricity prices on the day ahead market. We quantify the impact of both average price and price volatility on the hypothetical storage plant revenue in both markets. We find that volatility is the primary driver of storage revenue and despite large deployments of renewable generation, the potential revenue has not increased particularly in either market over this period. The notable exception to this was the last quarter of 2016 when unplanned outages in the French Nuclear fleet led to exceptionally high electricity prices at peak times in the GB electrical system. These unplanned outages meant that France, which normally exports electricity into the UK through the Thanet interconnector, became a net importer of power which tightened capacity margins at peak times.

The analysis draws some interesting conclusions for bulk electricity storage, highlighting the challenges faced by bulk storage developers. In particular, the large deployments of renewable energy in both countries have so far failed to produce any reliable increase in market favourability for storage. One possible explanation is that electricity from renewable sources has predominantly displaced baseload generation (like coal) and the marginal plants have stayed the same or increased their production, keeping price levels similar at peak times but decreasing daytime prices. Rationally, we would expect this relationship to breakdown eventually as the current fleet of marginal plant can no longer meet all the demand at peak times, and new capacity must be constructed which will increase costs and reliably push up peak electricity prices. Indeed, several organisations have suggested that Britain capacity margin is tightening significantly.

The falling domestic demands in both GB and DE have also likely dampened markets for storage. This falling demand is thought to be largely a consequence of the financial crisis of the late 2000’s, therefore any sustained period of economic activity could significantly impact peak electricity prices and create a more favourable environment for storage. Finally, this work has examined the day-ahead market, which is just one in a number of electricity markets.